Stock market investing may be both thrilling and overwhelming. Whether a beginner or a professional investor, the correct book can give you the strategies, information, and confidence required to survive the intricate realm of stocks. Here, we have compiled a list of more than 10 of the top stock market investing books. These classic resources not only provide insightful lessons on value investing and market psychology but also assist you in cultivating a disciplined, long-term wealth-building method.

Stock market investing books are irreplaceable tools that condense decades of experience, research, and hard-earned wisdom. From Benjamin Graham’s seminal value investing treatises to Peter Lynch’s readable strategies, these books have influenced the investment philosophies of the likes of Warren Buffett. Here in this guide, we shall discuss our best choices and illustrate how these can assist you in honing your investment skills and generating long-term financial returns.

What Are Stock Market Investing Books?

Stock market investing books are learning materials that provide tips on choosing stocks, recognizing market trends, and risk management. They tackle various issues, such as:

- Value Investing: Strategies for buying undervalued stocks.

- Growth Investing: Identifying companies with strong potential for future growth.

- Market Psychology: Understanding the behavior of investors and market cycles.

- Technical and Fundamental Analysis: Tools for evaluating stock performance and financial health.

These books are meant to equip investors with the information they require to make wise choices and avoid potential pitfalls.

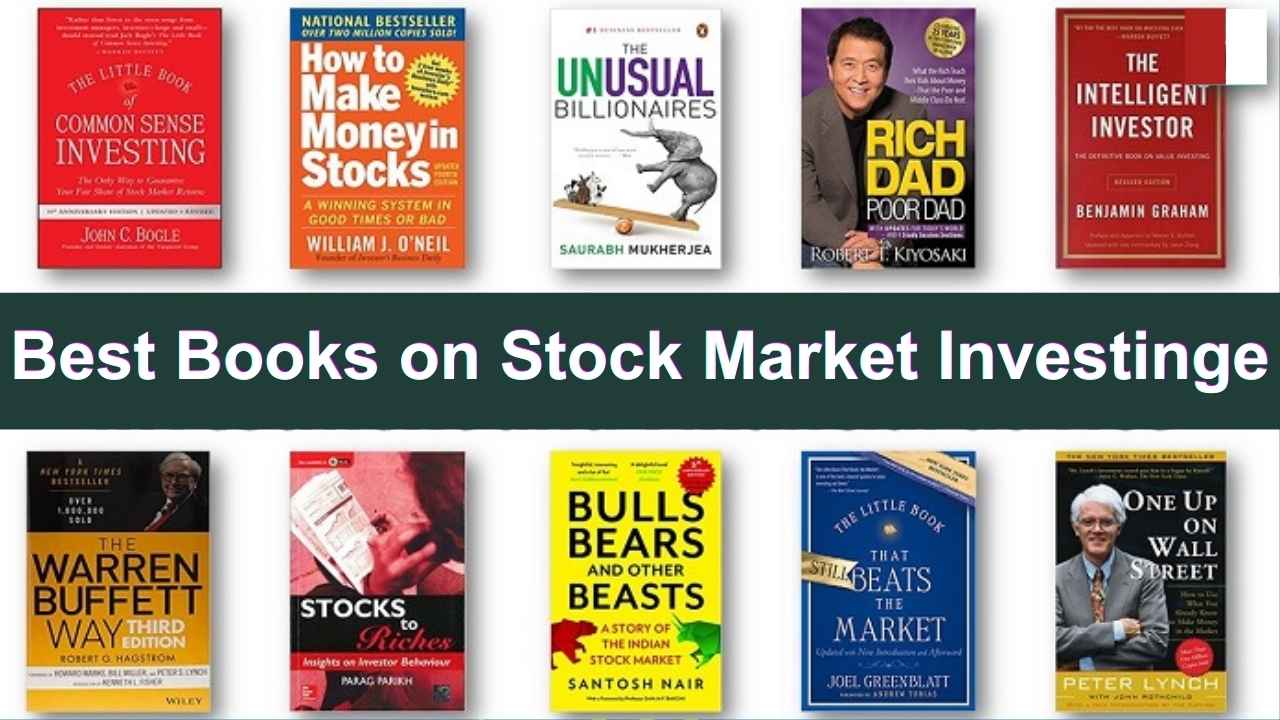

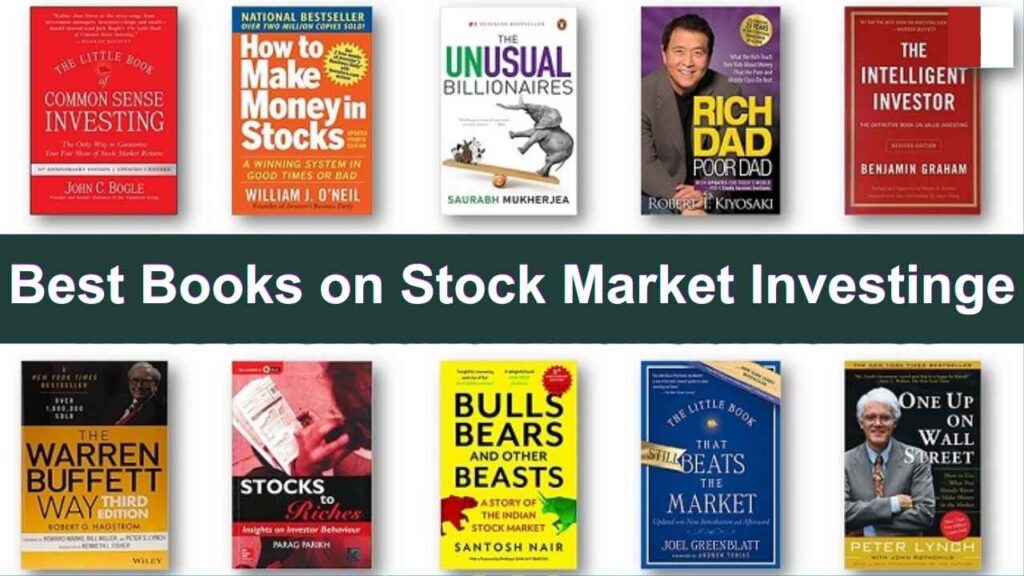

Top 10+ Best Books on Stock Market Investing

Following is a carefully curated list of the top investing books, all presenting different insights and approaches. Use this table as a fast reference to select your next must-read:

| Sl No. | Book Title | Author | Key Focus |

|---|---|---|---|

| 1 | The Intelligent Investor | Benjamin Graham | Value investing; long-term strategies; margin of safety |

| 2 | One Up on Wall Street | Peter Lynch | Investing in what you know; stock picking fundamentals |

| 3 | A Random Walk Down Wall Street | Burton Malkiel | Efficient market hypothesis; index investing |

| 4 | Common Stocks and Uncommon Profits | Philip A. Fisher | Qualitative analysis; growth investing |

| 5 | The Little Book of Common Sense Investing | John C. Bogle | Index funds; low-cost investing; market returns |

| 6 | Stocks for the Long Run | Jeremy J. Siegel | Historical market trends; long-term portfolio building |

| 7 | You Can Be a Stock Market Genius | Joel Greenblatt | Special situation investing; contrarian strategies |

| 8 | Margin of Safety | Seth Klarman | Risk-averse value investing; protecting capital |

| 9 | Beating the Street | Peter Lynch | Practical stock analysis; personal investment stories |

| 10 | Security Analysis | Benjamin Graham & David Dodd | Deep fundamental analysis; advanced investment techniques |

| 11 | The Essays of Warren Buffett | Warren Buffett (compiled by Lawrence Cunningham) | Investment philosophy; management insights |

Note: While these books provide a strong foundation, remember that some, like Security Analysis*, are more advanced and best suited for investors ready to dive deeper into the numbers.*

How to Choose the Right Investing Book

With so many choices, finding the book best suited to your requirements can be difficult. Below are some guidelines:

- Assess Your Knowledge Level: Beginners might start with more accessible reads like One Up on Wall Street or The Little Book of Common Sense Investing. More experienced investors can tackle advanced texts like Security Analysis.

- Define Your Investment Goals: Are you interested in value investing, growth investing, or understanding market psychology? Choose a book that aligns with your strategy.

- Check Author Credibility: Look for books by authors with proven track records. Legends like Benjamin Graham, Peter Lynch, and Warren Buffett offer timeless insights backed by years of success.

- Read Reviews and Recommendations: Check trusted sources such as Goodreads, Forbes, or financial blogs to see what other investors have to say.

Conclusion

The proper investing book can be a game changer on your path to financial success. Learning from the masters, you can construct a solid investment plan, prevent common pitfalls, and develop the discipline necessary for long-term wealth creation. Whether you’re a beginner or want to go deeper, the books on our list provide priceless lessons that have withstood the test of time. Choose one, read it, and let these ageless lessons lead you to wiser investing.

Using these timeless classics as part of your investment training, you’ll be in a much better position to make decisions and prosper in the ever-changing world of stock market investing. Enjoy reading and investing!

FAQs: Best Books on Stock Market Investing

What makes The Intelligent Investor a must-read?

Written by Benjamin Graham, it lays the foundation for value investing and emphasizes the importance of a margin of safety and long-term strategies.

Are these books suitable for beginners?

Yes, several titles like One Up on Wall Street and The Little Book of Common Sense Investing are excellent starting points for new investors.

How can I apply the strategies from these books to my own investments?

Start by understanding the core principles, then gradually implement techniques such as value analysis, portfolio diversification, and risk management into your investment plan.

Should I read more than one investing book?

Absolutely. Each book offers different perspectives and strategies. Reading multiple books will give you a well-rounded understanding of the market.

Where can I find these books?

Most of these titles are available at major bookstores, online retailers like Amazon, or your local library.