Hello! If you’re considering getting your feet wet in the investment world, mutual funds are a great option. They’re essentially a basket of stocks, bonds, or other investments held by experts who make it simple for people like you and me to increase our money without needing to know it all. But here’s the catch: although mutual funds are pretty simple, lots of folks stumble and make errors that can be costly.”.

In this article, I’ll take you through some of the most frequent errors that occur when investing in mutual funds. I’ll keep it straightforward, explain why these mistakes occur, and provide you with advice on how to steer clear of them. Whether you’re a newcomer or have some background knowledge, staying clear of these missteps can assist you in making wiser decisions and establishing a stronger financial future. Let’s get started!

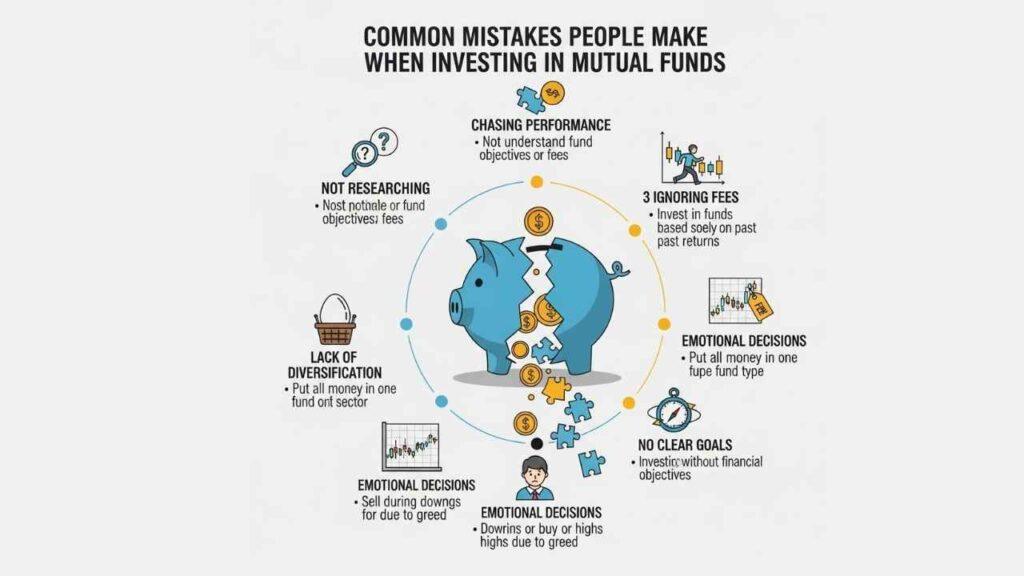

Common Mistakes People Make When Investing in Mutual Funds

1. Not Understanding What You’re Investing In

One of the largest mistakes is investing in a mutual fund without actually knowing what it is. Think about purchasing a car without looking to see if it’s a truck or a sedan – you might get something that isn’t suitable for you.

Mutual funds are of various kinds: equity funds (investing in stocks for long-term growth but with greater risk), debt funds (safe, betting on bonds), or hybrid funds (a combination of the two). Individuals tend to choose one based on a word of mouth from a friend or a flash ad, without checking what the fund is targeting or at what risk.

Why it’s a mistake: Unless the fund aligns with your aims – such as retirement versus a short-term getaway – you might lose money or miss a better investment opportunity.

How to avoid it: Spend time doing your research. Read the prospectus of the fund (imagine it as the instruction manual). Ask yourself: Is this within my risk tolerance? Employ free online resources or a financial advisor to learn the fundamentals. Knowledge is your best ally here.

2. Chasing Past Performance Like It’s a Guarantee

We’ve all heard the phrase, “Past performance is not indicative of future results,” but how many of us disregard it? Many! They look at a fund that performed incredibly well last year and say, “This is the one!” They invest money in, hoping the magic to repeat.

But things turn around. An investment that was flying due to a scorching sector may tank when the trends reverse. It’s like placing a bet on a sports team just because they won last season – without considering injuries or fresh players.

Why it’s a mistake: It results in buying highs and selling lows, just the opposite of being smart about investing. You find yourself disappointed when the returns fall.

How to avoid it: Consider long-term performance, e.g., over 5-10 years, and compare it with other similar funds. Pay attention to the strategy and consistency of the fund manager. Diversify across funds rather than putting all in one “star” basket.

3. Ignoring Fees and Expenses

Fees may appear minimal, but they accumulate like droplets from a dripping faucet that becomes a flood. Mutual funds also charge expense ratios (a percentage of your investment as management fees), load fees (for purchases or sales), and sometimes other unseen expenses.

They overlook these many times, saying, “It’s just a little bit.” But eventually, high fees can take a huge bite out of your returns. For instance, a 1% greater fee on a $10,000 investment might cost you thousands over 20 years.

Why it’s a mistake: It takes money out of your net profit without you even realizing it, particularly for low-return funds.

How to avoid it: Always compare expense ratios – aim for under 1% for most funds. Choose no-load funds if possible. Tools like fund comparison websites can help spot cheaper options with similar performance.

4. Trying to Time the Market

Oh, the old standby: “I’ll buy when the market is down and sell when it’s up.” Sounds ideal, doesn’t it? Unfortunately, though, timing the market is akin to forecasting the weather – sometimes you’ll call it right, but usually, you’ll be wrong.

Individuals hold back for the “ideal” time, lose out on gains, or sell in a panic during a slide. Mutual funds are for holding, not day-trading.

Why it’s a mistake: You can’t predict markets. Research indicates that being in the market typically outperforms attempting to time it.

How to avoid it: Invest through a systematic investment plan (SIP), wherein you invest an amount regularly, irrespective of the fluctuations in the market. This helps spread costs over the long run. Don’t forget, time spent in the market is more important than timing the market.

5. Not Diversifying Your Investments

Investing all your money in one or two funds is like having only pizza for dinner every day – it can be fun to start with, but it’s unhealthy and may get you ill.

Diversification is about spreading your investments over varied types of assets, sectors, and locations in order to minimize risk. But many invest in what they know, such as only Indian equity funds if they’re based in India, and not looking at global possibilities.

Why it’s a mistake: When one sector collapses (i.e., tech bubble bursts), your entire portfolio takes the hit.

How to avoid it: Create a blend: equity, debt, possibly international holdings. Rebalance annually to maintain the balance. Index funds, tracking broad markets, are an easy way to diversify with minimal effort.

6. Making Emotional Decisions

Investing is not numbers; there’s a huge emotional component. Fear when markets crash and selling low, greed when they boom and buying high. It’s natural, but it hurt your pocket.

Example: After hearing news of economic slumps, people redeem mutual funds, missing the subsequent recovery.

Why it’s a mistake: Emotions get in the way and cloud judgment, causing hasty actions that ruin long-term planning.

How to avoid it: Establish clear guidelines in the beginning, such as “I’ll hold for at least 5 years.” Refrain from looking at your portfolio every day – monthly or quarterly is sufficient. If necessary, work with an advisor so you can remain objective.

7. Forgetting to Review and Rebalance

After you’re invested, some folks set it and forget it. Your life changes – your job, family, or objectives change – but your money doesn’t.

Without annual check-ups, your portfolio could stray from its initial strategy. For instance, if equities rise more quickly than anticipated, you have a higher risk than planned.

Why it’s a mistake: It may cause imbalances, increased risks, or lost opportunities.

How to avoid it: Check in at least once a year. Rebalance by selling high performers and buying underperformers in order to keep your desired mix. Apps and robo-advisors can take care of it for you.

8. Investing Without Clear Goals

Beginning without a “why” is similar to driving without a place to go – you may end up going around in circles. Some invest because “everyone’s doing it” or “to make money,” without connecting it to definite goals such as purchasing a home or paying for education.

Why it’s a mistake: It makes it difficult to select the correct funds or remain committed during bad times.

How to avoid it: Prioritize goals first: near term (1-3 years, low risk) or far term (5+ years, higher risk acceptable). Align funds accordingly. Monitor progress towards such goals, not merely returns..

Wrapping It Up: Invest Smarter, Not Harder

Investing in mutual funds is a good way to accumulate wealth, but success depends on avoiding the usual pitfalls. Just recall that it’s not about getting rich over night; it’s about making consistent, informed decisions. Begin with small amounts, and as you progress, learn and do not mind asking for professional advice if in doubt.

If you’ve ever done any of these errors in the past, comment below – you’re not the only one! And if this post was helpful, go ahead and bookmark it or share with a friend. Good investing, and to your financial independence!

Disclaimer: It’s not financial advice. Do your own research or consult with a certified professional prior to investing.