A low CIBIL score can seem like a significant hurdle when applying for a personal loan. In India, a credit score is one of the key factors lenders consider to determine a borrower’s creditworthiness. However, having a low score does not necessarily mean you’re out of options. With the rise of alternative lending options and flexible eligibility criteria in 2024, it’s possible to secure a personal loan even with a less-than-perfect credit history.

This is a comprehensive guide to practical strategies, loan options, and lenders catering to low-credit-scoring individuals in India.

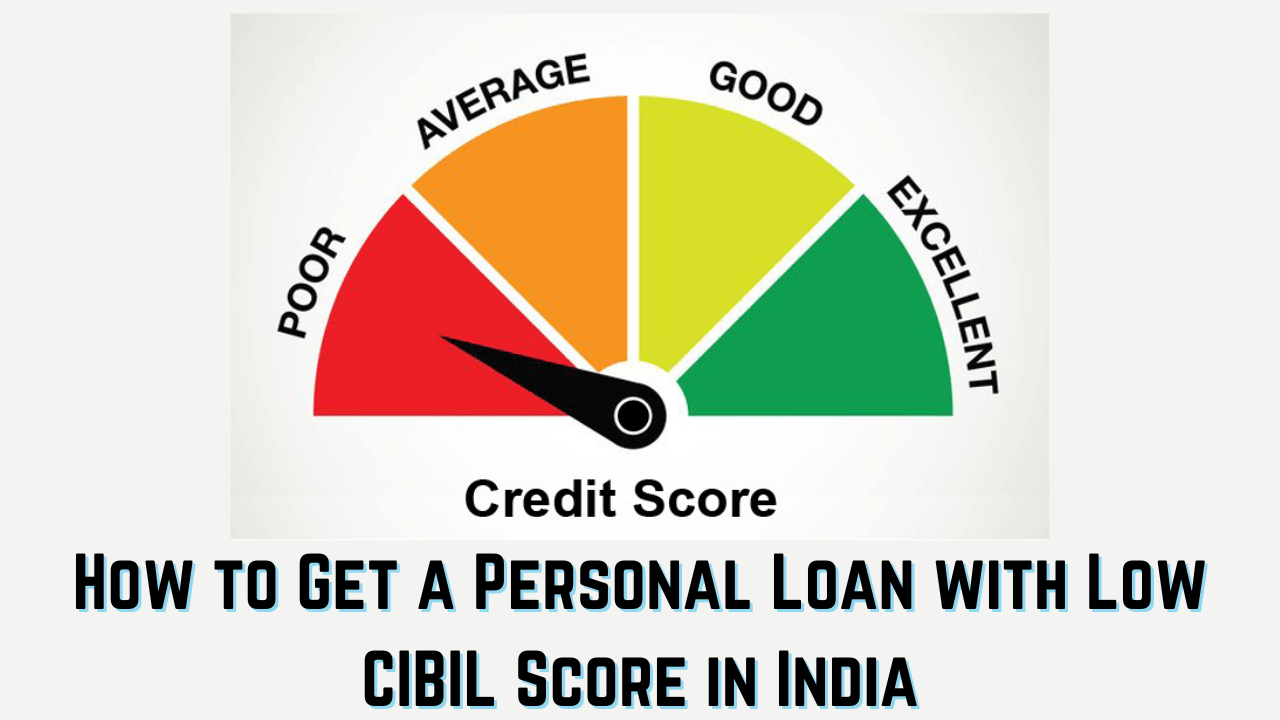

What Is a CIBIL Score, and Why Does It Matter?

It happens to be a three-digit number between 300 and 900 by the Credit Information Bureau (India) Limited. It works as a pointer towards your creditworthiness based on the financial history depicted. The lenders in India give this score to determine their risk while advancing money to you.

- 750 and Above: Excellent score; easier approval with favorable terms.

- 600-749: Average score; approval possible but with higher interest rates.

- Below 600: Low score; high chances of rejection or loans with stringent terms.

A low score is caused by missed payments, defaults, or a high credit utilisation. However, in 2024, most lenders in India have started to look beyond the credit scores and consider a more comprehensive view of financial stability.

Challenges of Getting a Personal Loan with Low CIBIL Score

- Higher Interest Rates: Lenders often compensate for the increased risk by charging higher rates.

- Lower Loan Amounts: Borrowers with low scores may be eligible for smaller loan amounts.

- Limited Options: Traditional banks may outright reject applications with poor credit history.

- Strict Terms: Shorter repayment tenures or collateral requirements might apply.

Despite the disadvantages listed above, alternative lenders, secured loans, and P2P platforms have made borrowing less problematic.

Steps to Get a Personal Loan with Low CIBIL Score in India

1. Research lenders who accept lower credit scores

Not all lenders are strict about their CIBIL score requirement. One can find loans from NBFCs and fintech companies that are specially meant for low credit scores. They usually do not have a focus on the CIBIL score; instead, they glance upon the following:

- Monthly income

- Employment stability

- Bank transaction history

2. Opt for Secured Loans

Providing gold, property, or a fixed deposit can increase your chances of being approved. Secured loans are risk-free for lenders, and they will easily approve your loan application even though it has a bad credit score.

3. Apply with a Co-Applicant or Guarantor

Having a good credit score guarantor or a co-applicant will make your loan application stronger. The creditworthiness of a guarantor or a co-applicant will balance out your low score.

4. Choose Smaller Loan Amounts

Requesting a lower loan amount increases your chances of approval. Lenders are more likely to approve smaller loans as they pose less risk.

5. Provide Proof of Stable Income

Submitting salary slips, bank statements, or tax returns can reassure lenders of your ability to repay. A stable income indicates reliability and reduces the perceived risk.

6. Avoid Multiple Loan Applications

Applying to various lenders in a short period will also decrease your CIBIL score. Instead, research and approach only the most suitable lenders.

Comparison Table: Traditional Banks vs. NBFCs and Fintech Lenders

| Feature | Traditional Banks | NBFCs & Fintech Lenders |

|---|---|---|

| CIBIL Score Requirement | High (750 and above) | Low to moderate (550 and above) |

| Interest Rates | Lower (10%-14%) | Higher (12%-36%) |

| Approval Time | Longer (7-15 days) | Faster (1-3 days) |

| Loan Amount | Higher amounts available | Moderate to smaller loan sizes |

| Collateral Requirement | Sometimes required | Rarely required |

| Eligibility Criteria | Strict | Flexible |

| Documentation | Extensive | Minimal |

Alternative Loan Options for Low CIBIL Scores

1. Gold Loans

If you have gold jewelry or coins, then gold loans are a very good option for you. Banks and NBFCs lend money against gold with not much focus on the score or credit report.

- Advantages: Lower interest rates, quick approval.

- Disadvantage: Requires gold as collateral.

2. Loan Against Fixed Deposit

If you already possess a fixed deposit, you can open a loan against it. In general, the rate of interest on this loan is 1%-2% above the FD rate.

- Advantages: Guaranteed approval with favorable terms.

- Disadvantage: Requires a fixed deposit.

3. Peer-to-Peer Lending (P2P)

Peer-to-peer lending websites directly connect borrowers directly with individual lenders. Your CIBIL score and other parameters play a lesser role, and sometimes terms could also be flexible.

- Advantages: Flexible eligibility, personalized rates.

- Disadvantage: Higher interest rates than traditional loans.

Strategies to Improve Your CIBIL Score

Though a loan may be necessary, boosting the CIBIL score opens several more doors in the years to come. Some of the tips include:

- Pay EMIs on Time: Late payments negatively affect your credit score. Always pay your dues promptly.

- Reduce Credit Utilization: Keep your credit card usage below 30% of your limit.

- Avoid Frequent Borrowing: Multiple credit inquiries can lower your score.

- Check for Errors in Your Report: Regularly review your CIBIL report for inaccuracies and raise disputes if needed.

- Maintain a Healthy Credit Mix: A combination of secured and unsecured loans shows financial maturity.

Top Lenders for Low CIBIL Score Loans in India (2024)

Here are some lenders known to offer personal loans for individuals with low credit scores:

1. Bajaj Finserv

- Interest Rate: 13%-25%

- Approval Time: 24-48 hours

- Special Feature: Flexi personal loan option

2. MoneyTap

- Interest Rate: 13%-36%

- Approval Time: Instant credit line approval

- Special Feature: Flexible repayment tenure

3. Fullerton India

- Interest Rate: 12%-36%

- Approval Time: 1-2 days

- Special Feature: Personalized offers for salaried individuals

4. LoanTap

- Interest Rate: 14%-24%

- Approval Time: 24 hours

- Special Feature: EMI-free loan options

Conclusion

A low CIBIL score might limit your borrowing options, but it doesn’t close the door entirely. In fact, with 2024’s progress in the Indian lending landscape, all types of individuals with different financial histories can easily acquire a personal loan from different options like NBFCs, fintech lenders, and alternative options such as gold loans and P2P platforms.

However, always borrow responsibly. Understand the terms, ensure you can repay on time, and work on improving your CIBIL score to have better financial opportunities in the future.

FAQs

Can I get a personal loan with a CIBIL score below 600?

Yes, many NBFCs and fintech lenders in India offer loans to individuals with scores below 600, though at higher interest rates.

How do I quickly repair my CIBIL score?

Ensure timely EMI payments, reduce credit utilization, and refrain from taking multiple loans back to back.

What is the rate of interest for personal loans if I have a low CIBIL score?

Obviously, all the low CIBIL score personal loan interest rates would range between 12% and 36% based on the lender and your respective credit profile.

Gold loans or personal loans – which is preferred?

Gold loans are that gold loans usually carry less interest rates, and the eligibility criteria are also lenient.

How does collateral help in getting a loan with low CIBIL score?

Collateral reduces the risk on the lender’s side, increasing the possibility of getting approval for a loan despite having a bad credit score.