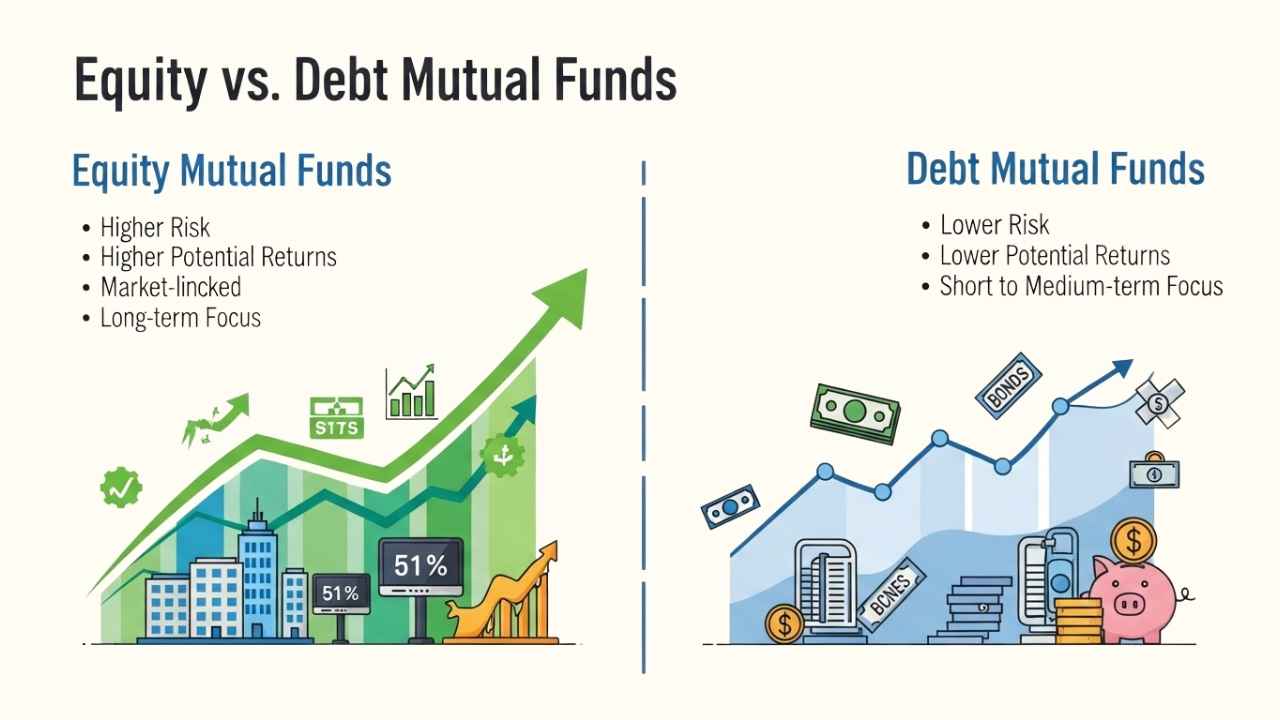

Mutual funds are a popular way to invest in the stock market. They offer diversification, which means you don’t put all your money in one place. This helps reduce risk. There are two main types of mutual funds: equity mutual funds and debt mutual funds. Let’s understand the difference between them.

What Are Equity Mutual Funds?

Equity mutual funds invest in shares of companies listed on the stock market. These funds aim to provide higher returns over the long term. The returns depend on how well the stock market performs. Equity funds are suitable for investors who want to grow their wealth and can handle some risk.

Key Points About Equity Funds

- Investments: Shares of companies traded in the stock market.

- Risks: Moderately high to high risk.

- Returns: Higher in the long term.

- Investment Horizon: Best for long-term goals.

- Taxation: Short-term capital gains (held less than 12 months) are taxed at 15%. Long-term gains (held more than 12 months) are taxed at 10% on gains above ₹1 lakh.

- Tax Savings: You can claim a tax deduction of up to ₹1.5 lakh per year if you invest in Equity Linked Savings Scheme (ELSS).

What Are Debt Mutual Funds?

Debt mutual funds invest in fixed-income securities like government bonds, corporate bonds, and treasury bills. These funds aim to provide stable returns with lower risk. Debt funds are suitable for investors who want regular income and prefer less risk.

Key Points About Debt Funds

- Investments: Securities that generate fixed income, like bonds and treasury bills.

- Risks: Low to moderate risk.

- Returns: Lower compared to equity funds.

- Investment Horizon: Suitable for both short and long-term goals.

- Taxation: Short-term capital gains (held less than 36 months) are taxed as per your income tax slab. Long-term gains (held more than 36 months) are taxed at 20% with indexation benefits.

- Tax Savings: No tax benefits available on debt funds.

Equity Fund vs Debt Fund: Comparative Analysis

| Particulars | Equity Funds | Debt Funds |

|---|---|---|

| Investments | Shares of companies | Fixed-income securities |

| Risks Involved | Moderately high to high | Low to moderate |

| Returns | Higher in the long term | Lower in comparison |

| Investment Horizon | Suitable for long-term goals | Suitable for both short and long-term |

| Tax Savings | Up to ₹1.5 lakh per year (ELSS) | No tax benefits |

Factors to Consider Before Investing

Equity Funds

- Size of the Fund: Larger funds can offer better returns.

- Expense Ratio: Lower expense ratios mean more returns for you.

- Risk-Reward Ratio: Higher risk can mean higher returns, but also higher losses.

Debt Funds

- Expense Ratio: Lower expense ratios are better.

- Management Fee: Some funds charge higher management fees.

- Risk Appetite: Choose funds that match your risk tolerance.

Conclusion

Debt funds are safer and provide stable returns, making them ideal for investors who want regular income and lower risk. Equity funds offer higher returns but come with higher risk, making them suitable for long-term investors who can handle market volatility.

Before choosing between equity and debt funds, consider your risk appetite, investment horizon, and financial goals. A balanced mix of both can help you achieve your financial objectives while managing risk.

Disclaimer: This blog is for educational purposes only. The securities/investments quoted here are not recommendatory.