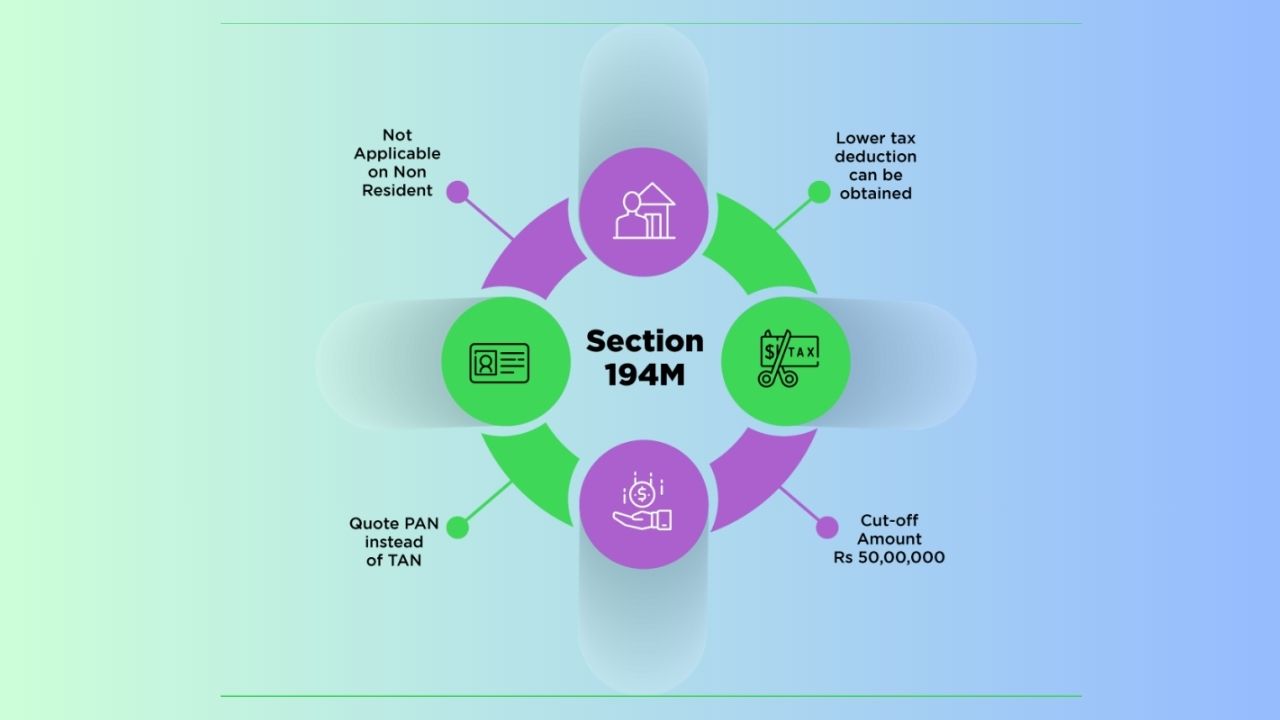

The 2019 Union Budget introduced various tax reforms to facilitate taxpayers. One significant alteration involved the introduction of Section 194M in the Income Tax Act. The section is concerned with Tax Deducted at Source (TDS) on payments made by individuals and Hindu Undivided Families (HUFs). Previously, numerous such payments were not taxed, and tax evasion was possible through this loophole. Section 194M bridges the gap by requiring some payers to withhold tax while they make a large payment.

What Is Section 194M?

Section 194M mandates the deduction of TDS on payment of resident contractors, professionals, or commission agents by individuals and HUFs, if the aggregate of such payments during a year is more than ₹50 lakh. The intention is to catch the transactions that are large enough to be significant but were outside the purview of other TDS provisions (e.g., Section 194C, 194H, or 194J).

Applicability of Section 194M

- Threshold Limit: The rule applies only when total payments in a financial year exceed ₹50 lakh.

- Who Is Covered: Only individuals or HUFs (not companies or firms) who pay for work, professional services, or commission/brokerage.

- Who Is Exempt: Smaller taxpayers (total payments under ₹50 lakh) do not have to worry about Section 194M.

Who Must Deduct TDS?

If an individual or HUF pays more than ₹50 lakh in a year to:

- A resident contractor or professional, or

- A commission or brokerage agent

they must deduct TDS at the time of payment. This is true only if they are not already covered under Sections 194C (contractors), 194H (commission), or 194J (professional fees).

Services Covered under Section 194M

- Work or Contract Services

- Advertising

- Broadcasting or telecasting programs

- Goods or passenger transport (other than rail)

- Catering

- Manufacturing to a customer’s design (using materials supplied by that customer)

- Construction, repair, or other contractual work

- Professional Services

- Legal, medical, accountancy, architecture, engineering

- Technical consultancy, interior decoration

- Any other services notified by the government

- Commission or Brokerage

- Any payment to an agent or broker for arranging sales, purchases, or services

TDS Rate & Threshold

- Threshold: ₹50 lakh in total annual payments.

- Normal Rate: 5% on the entire payment.

- PAN Not Available: 20% rate applies if the payee’s PAN is missing.

- Temporary COVID‑19 Rate: From May 2020 to March 2021, TDS was cut to 3.75%, but it returned to 5% on April 1, 2021.

Example

- Commission Payment: Mr. A pays ₹1 crore to Mr. B as commission. Since ₹1 crore exceeds ₹50 lakh, Mr. A must deduct 5% TDS on the full ₹1 crore, i.e. ₹5 lakh.

- Repair Work: Mr. B pays Mr. C ₹45 lakh for repair work. Here, ₹45 lakh is below the ₹50 lakh threshold, so no TDS is needed.

Payment & Compliance under Section 194M

- When to Deduct: At the time of payment—by cash, cheque, draft—or on crediting the amount to the payee’s account.

- Form 26QD: The deductor must file Form 26QD within 30 days from the end of the month in which TDS was deducted.

- Example: Payment on May 9 → Form 26QD due by June 30.

- Form 16D: The deductor must issue a TDS certificate (Form 16D) to the payee within 15 days of filing Form 26QD.

No Need for TAN

Individuals or HUFs deducting TDS under Section 194M do not need to obtain a Tax Deduction and Collection Account Number (TAN). This simplifies compliance for smaller entities.

Exceptions & Penalties

- Exception: If total payments in a year are under ₹50 lakh, Section 194M does not apply.

- Penalty for Non‑Deduction or Late Deposit:

- Interest at 1% per month on the undeducted or late-deposited TDS amount.

- A fine up to ₹10,000 may also be imposed.

Conclusion

Section 194M extended the TDS net to individual and HUF payers with big transactions. Setting a definite ₹50 lakh limit and 5% TDS ensures limiting tax evasion while continuing to grant relief to low-key taxpayers. All individuals or HUFs making big payments for employment, services, or commissions must know these provisions to remain compliant and avoid penalty.