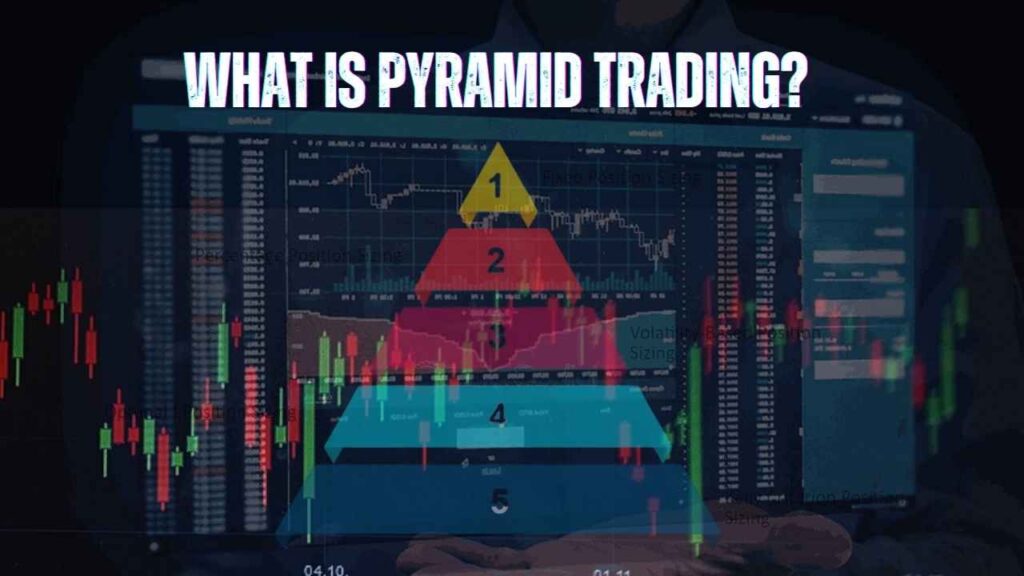

Pyramid trading provides a means of scaling into a position over time, thereby allowing traders to take advantage of profitable trades while maintaining potential losses under control. Pyramid trading entails adding to a position as it becomes profitable, building a “pyramid” effect, with the base being the original investment and the following layers being additional positions added at higher price levels.

Whether you are new to trading and want to learn a new strategy or an experienced trader wanting to improve your strategy, learning about pyramid trading can assist you in better structuring your trades under different market conditions.

What is Pyramid Trading?

Pyramid trading is a strategy investors employ to ramp up the size of their position as the trade works in their direction. Rather than putting in a lot of money upfront, traders put in a small amount and then build up extra shares or contracts when the price appreciates. The intention is to take advantage of a winning trend without exposing much risk through an initial smaller amount of money.

Key Features:

- Incremental Position Building: Start with a small position, and add more units in stages.

- Controlled Risk: Each subsequent addition is made using only a portion of the capital and often at higher price levels.

- Profit Maximization: By scaling into the trade, you can potentially capture more gains as the market trend continues.

- Stop-Loss Consideration: Effective pyramid trading always includes protective stops to safeguard against reversals.

How Does Pyramid Trading Work?

The pyramid trading strategy typically follows these steps:

- Initiate the Position:

Enter the market with a modest investment based on your analysis. The initial position is deliberately smaller to limit risk exposure. - Monitor Market Movements:

As the market moves in your favor, evaluate if the trend is strong enough to warrant adding to your position. Use technical indicators like moving averages, trend lines, and volume to confirm the upward momentum. - Add Incrementally:

Increase your position gradually as the price continues to rise. The additional units should be added at predetermined price levels or when the trend strength is confirmed. - Manage Risk:

Adjust your stop-loss levels as you add new layers to the pyramid to ensure that the overall risk is managed effectively. Protecting gains is crucial in pyramid trading. - Exit Strategy:

Establish clear exit criteria for profit-taking or limiting losses. This could involve setting target prices or using trailing stops to capture the maximum upside while protecting against reversals.

Advantages of Pyramid Trading

- Profit Maximization:

By adding to a winning position, you can leverage a successful trend and maximize potential gains. - Risk Management:

Since you begin with a smaller position, your initial risk is minimized. Each additional investment is made when the trade already shows success, reducing overall risk. - Capital Efficiency:

Pyramid trading allows you to deploy your capital gradually. This helps in preserving funds for other opportunities and managing liquidity more effectively. - Flexibility:

The strategy is adaptable and can be used in various market conditions. It’s effective in trending markets and can be combined with other trading strategies for enhanced performance.

Disadvantages and Risks of Pyramid Trading

- Complex Execution:

Pyramid trading requires meticulous planning and discipline. Adding to positions at the wrong time can lead to overexposure and significant losses if the market reverses. - Emotional Trading:

The strategy may encourage traders to become overly confident during a winning streak, leading to impulsive decisions that disrupt the planned pyramid structure. - Increased Transaction Costs:

Multiple entries mean increased brokerage fees and potential slippage, which can eat into profits over time. - Market Volatility:

In highly volatile markets, the price can fluctuate widely, making it challenging to predict optimal entry points for additional investments.

Tips for Successful Pyramid Trading

- Set Clear Rules:

Establish precise entry and exit points based on technical analysis and stick to them, regardless of market sentiment. - Risk Management:

Always use stop-loss orders and adjust them as you add new layers to your pyramid. This protects your entire position from sudden reversals. - Be Disciplined:

Avoid the temptation to pyramid too aggressively. Maintain a balanced approach to ensure that each additional investment is justified by solid market data. - Monitor the Market:

Stay updated on market conditions and be prepared to exit your position if trends start to reverse. Flexibility and quick decision-making are crucial for pyramid trading success. - Start Small:

If you’re new to pyramid trading, begin with a small portion of your trading capital to gain experience before scaling up.

Final Thought

Pyramid trading provides a strategic method to build into a successful trade step. step. step, maximizing the profits while optimizing the risk. But it’s a strategy that demands discipline, careful planning, and continuous monitoring of the markets. For those traders who are able to master the skill of incremental entries and disciplined exits, pyramid trading can be an effective tool to maximize your returns. As always, it is imperative to pair this strategy with effective risk management procedures and ongoing learning to ride through the constantly changing dynamics of the financial markets.

Frequently Asked Questions (FAQ)

Q1. What is pyramid trading?

A: Pyramid trading is a strategy where traders build their position incrementally by adding to an existing winning position. This allows them to capitalize on a continuing trend while managing risk.

Q2. How does pyramid trading help manage risk?

A: By starting with a small initial investment and gradually adding to it, traders reduce the risk exposure from a large upfront investment. Protective stop-loss orders are often used to manage overall risk.

Q3. What markets is pyramid trading suitable for?

A: Pyramid trading can be applied across various markets, including stocks, forex, and commodities, particularly in trending markets where price movements are strong and sustained.

Q4. Are there any drawbacks to pyramid trading?

A: Yes, pyramid trading can increase transaction costs, require high discipline, and may lead to overexposure if not executed correctly. It is best suited for experienced traders.

Q5. How can I get started with pyramid trading?

A: Start by learning and practicing with small positions, use a well-defined trading plan, and leverage risk management tools. Consider using a demo account to gain practical experience before investing real money.