How To Build A Stable Debt Fund Portfolio- Debt funds have had their share of tough times in India. From the ILFS crisis to issues in the NBFC sector, falling collateral values, and even alleged fund diversion scandals, investors learned some hard lessons about risk in debt investing. Many of these problems happened because mutual funds relied too much on credit ratings instead of doing their own thorough checks.

But does that mean you should avoid debt funds? Not at all. With the right approach, you can build a stable debt fund portfolio that gives you steady returns without taking unnecessary risks. In this guide, we’ll explain how to build a smart debt fund portfolio in simple English, and help you understand the different types of debt funds available in India.

Why Building a Stable Debt Portfolio Matters

The recent troubles in debt funds were painful, especially for investors who thought they were making safe investments. Many people invested in debt funds expecting low risk and capital protection, only to face losses or delays in getting their money back.

That’s why it’s more important than ever to understand how debt funds work, what risks they carry, and how to build a portfolio that matches your goals and risk tolerance.

How To Build A Stable Debt Fund Portfolio

Here’s a simple step-by-step approach to building a stable debt fund portfolio:

Step 1: Define Your Investment Goal

The first step is to be clear about why you’re investing. Are you saving for a short-term goal like a vacation or emergency fund? Or are you looking for steady income over a longer period? Your goal will determine which type of debt fund suits you best.

Step 2: Match Your Investment Horizon

Your investment time horizon is crucial when choosing debt funds. Here’s a simple guide:

- Less than 3 months: Invest in liquid funds. These are the safest and most stable, earning better returns than savings accounts. You can get your money back in under 30 minutes with instant redemption facilities.

- 3 to 6 months up to 2 years: Ultra-short-term funds are ideal for this period. They invest in short-term debt securities and offer good returns with moderate risk.

- 2 to 3 years: Short-term debt funds are suitable for this duration. They invest in instruments like Commercial Papers and Certificates of Deposit.

- Over 3 years: If you’re willing to take more risk, consider dynamically managed bond funds. An investment horizon of over 3 years also gives you tax advantages, as long-term capital gains tax rates are more favorable.

Step 3: Focus on Asset Allocation and Diversification

Don’t put all your money in one type of debt fund. Spread your investment across different categories based on your needs. For example, keep some money in liquid funds for emergencies, some in short-term funds for near-term goals, and some in longer-term funds if you have a 3+ year horizon.

Step 4: Prioritize Safety in the Current Environment

After recent troubles in the debt fund space, short-term maturity papers are becoming more attractive, and fund houses are adjusting their portfolios accordingly. If you want stability, focus on funds that invest in high-quality, short-maturity instruments rather than chasing higher returns with risky papers.

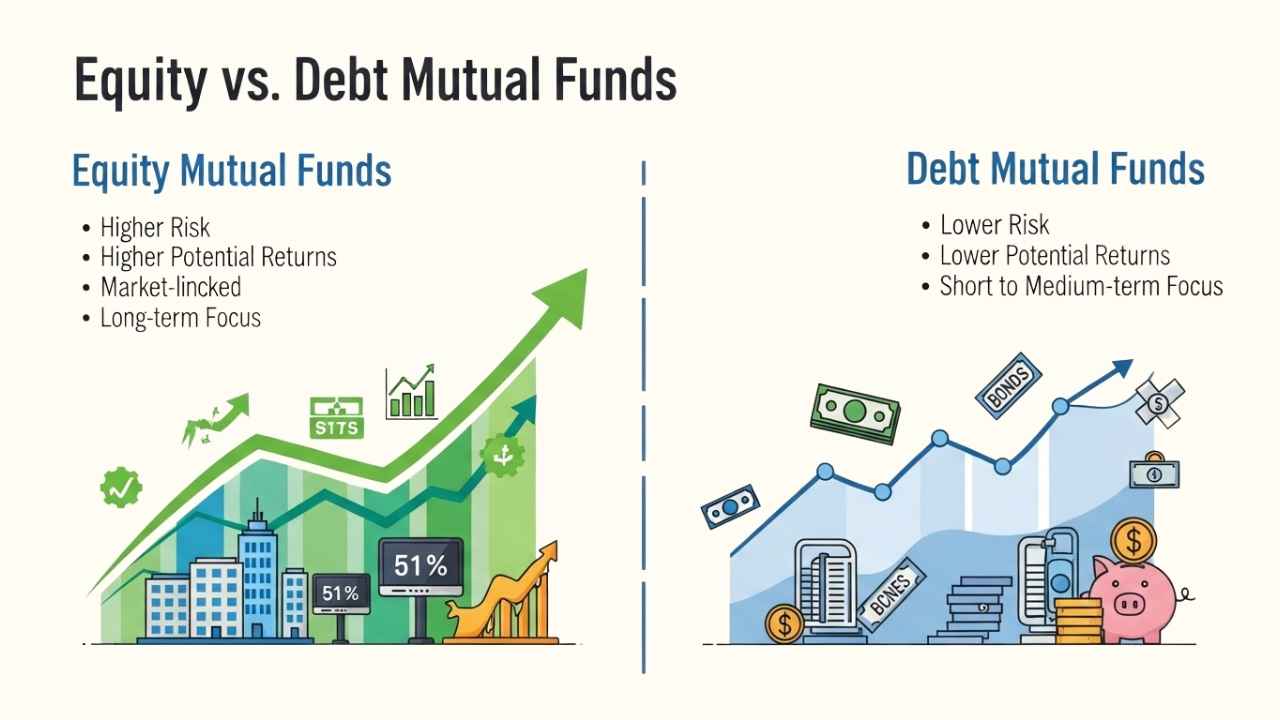

Types of Debt Mutual Funds in India

Debt funds invest in fixed-income instruments like corporate bonds, government bonds, treasury bills, and certificates of deposit. Here are the main types:

#1. Gilt Funds

Gilt funds invest only in government securities issued by central and state governments. There’s no credit risk since the government backs them. However, they are sensitive to interest rate changes, making long-term gilt funds riskier during periods of rising rates.

#2. Income Funds

Income funds invest in a mix of corporate debentures and government securities. They work well for long-term investments and are suitable for investors with a higher risk appetite who want to benefit from interest rate changes.

#3. Monthly Income Plans (MIPs)

MIPs invest mostly in debt (85-90%) with a small portion in equities (10-15%). They’re suitable for investors with lump sum amounts who want regular monthly income.

#4. Short-Term Funds

Best for investment durations of 3-6 months, short-term funds invest in Commercial Papers and Certificates of Deposit, offering decent returns with moderate risk.

#5. Ultra Short-Term Funds

These funds invest in short-term debt securities with small portions of long-term securities. They offer returns similar to short-term funds and are good for 3-6 months to 2-year horizons.

#6. Liquid Funds

Liquid funds are the most stable among debt funds, investing in highly liquid money market securities with maturities up to 91 days. They’re perfect for parking surplus money that you might need on short notice. Returns are more stable than other debt funds, and you can withdraw within a day or two.

#7. Fixed Maturity Funds

These funds have a fixed maturity period and invest in papers with matching maturity. They eliminate interest rate risk by holding securities until maturity, so the fund’s NAV isn’t affected by interest rate fluctuations.

#8. Dynamic Mutual Funds

Dynamic funds actively switch between short-term and long-term debt based on market conditions. They invest across all debt and money market instruments with no restrictions on maturity or investment type. They require active management and are taxed based on your holding period.

#9. Credit Opportunities Funds

Similar to dynamic funds, these invest across the maturity spectrum to generate higher interest income. They’re suitable for investors willing to take credit risk for potentially higher returns.

#10. Debt-oriented Hybrid Funds

These funds invest mostly in debt with a small equity portion (usually 10-25%). The equity exposure provides extra growth potential but also adds some risk compared to pure debt funds.

Key Tips for Building a Stable Debt Portfolio

- Don’t chase high returns: Higher returns usually come with higher risks in debt funds. Focus on stability and capital preservation.

- Check credit quality: After recent scandals, make sure your funds invest in high-quality papers with good credit ratings. Look at the fund’s portfolio holdings.

- Understand interest rate risk: Longer maturity funds are more sensitive to interest rate changes. In a rising rate environment, stick to shorter-maturity funds.

- Read the fine print: Understand what securities your fund invests in. Avoid funds with high exposure to risky corporate bonds or unrated papers.

- Review regularly: Don’t just invest and forget. Review your debt portfolio every quarter to ensure it still matches your goals and risk tolerance.

Final Thoughts

Building a stable debt fund portfolio takes research, patience, and a clear understanding of your goals. Take one step at a time, invest according to your risk appetite, and don’t get swayed by promises of very high returns.

Remember, debt mutual funds are not completely risk-free. They require the right strategy and careful selection to earn good returns while protecting your capital. By matching your investment horizon with the right type of debt fund, focusing on quality, and diversifying properly, you can build a debt portfolio that gives you steady, reliable returns.

Learn More:

- Blue-Chip Stocks vs. Penny Stocks

- Delivery vs Intraday Trading

- Difference in Expense Ratio Between Direct and Regular Mutual Funds

- Best Small-Cap Index Funds

- 10 Debt Mutual Funds That Outperformed in the Last 1 Year with 10% to 24% Returns in 2025

Disclaimer: This blog is for educational purposes only. The securities/investments mentioned here are not recommendations. Please consult a financial advisor before making investment decisions. Mutual fund investments are subject to market risks. Read all scheme-related documents carefully.