ULIPs vs PPF vs Mutual Funds- India has many investment options in terms of mutual funds, each catering to a specific investment objective. Even when it comes to planning for the future or securing your family’s future, and planning a savings strategy or planning a retirement strategy, it’s always important that the correct investment option has been chosen.

In this blog, we’ll compare and contrast three of the most popular ways of investing, which are ULIP plans (Unit-Linked Insurance Plans), PPF (Public Provident Fund), and Mutual Funds, and give you an objective comparison so you can choose the best option for you and your needs.

What is a ULIP (Unit-Linked Insurance Plan)?

A ULIP is a unique financial product that combines life insurance and investment in one package. When you pay a premium for a ULIP:

- A portion of your premium goes toward life insurance coverage.

- The remaining portion is invested in mutual funds (equity, debt, or a mix of both).

ULIPs offer the flexibility to choose between equity funds, debt funds, or balanced funds based on your risk tolerance. You also get regular updates on your investment performance and can switch between funds.

Key Features of ULIPs

- Dual Benefit: Insurance protection + investment growth.

- Lock-in Period: Mandatory 5-year lock-in period.

- Tax Benefits: Premium up to ₹1.5 lakh per year is deductible under Section 80C.

- Flexibility: You can switch between equity and debt funds.

- Charges: Premium allocation charges, mortality charges, fund management charges, and administration charges.

What is PPF (Public Provident Fund)?

The Public Provident Fund (PPF) is a government-backed, long-term savings scheme designed primarily for retirement planning. It’s one of the safest investment options in India and is ideal for conservative investors who want guaranteed returns.

Key Features of PPF

- Safety: Backed by the Central Government, making it completely risk-free.

- Lock-in Period: Mandatory 15-year lock-in, but the account can be extended in blocks of 5 years.

- Tax Benefits: Contributions up to ₹1.5 lakh per year are tax-deductible under Section 80C. Interest earned and maturity proceeds are also tax-free (EEE status).

- Investment Limits: Minimum ₹500 per year, maximum ₹1.5 lakh per year.

- Withdrawals: Partial withdrawal allowed from the 7th year onwards. Full withdrawal only after 15 years.

- Charges: Nominal one-time account opening charge of ₹100.

What are Mutual Funds?

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers and are ideal for wealth creation and regular income.

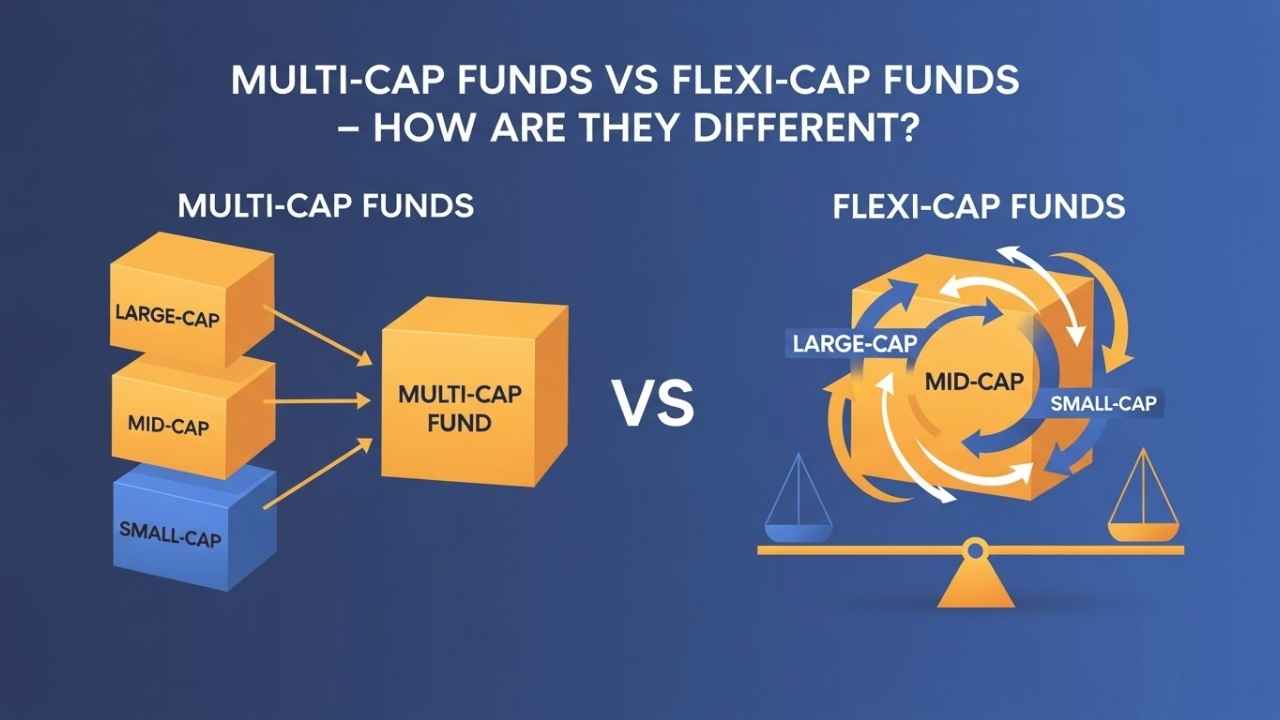

Types of Mutual Funds

- Equity Funds: Invest primarily in stocks. Higher risk, higher potential returns.

- Debt Funds: Invest in bonds and fixed-income securities. Lower risk, moderate returns.

- Balanced/Hybrid Funds: Invest in both equity and debt for balanced risk and returns.

Key Features of Mutual Funds

- Flexibility: You can start investing with as little as ₹500 per month through SIP (Systematic Investment Plan). No upper limit.

- No Mandatory Lock-in: Open-ended funds have no lock-in. ELSS (tax-saving funds) have a 3-year lock-in.

- Tax Benefits: ELSS funds offer tax deduction up to ₹1.5 lakh under Section 80C.

- Professional Management: Fund managers actively manage your portfolio.

- Charges: Annual fund management charges (expense ratio) and exit loads (in some cases).

- High Liquidity: Most funds (except ELSS) can be redeemed anytime.

ULIPs vs Mutual Funds vs PPF: Detailed Comparison

Here’s a side-by-side comparison to help you understand the key differences:

| Factor | Mutual Funds | ULIP | PPF |

|---|---|---|---|

| Investment Focus | Wealth creation or regular income | Insurance + wealth generation | Post-retirement income |

| Lock-in Period | No lock-in for most funds; ELSS has 3-year lock-in | 5 years | 15 years |

| Minimum Investment | ₹500 (via SIP) | Varies (depends on plan, usually higher) | ₹500 per year |

| Maximum Investment | No upper limit | Depends on plan | ₹1.5 lakh per year |

| Charges | Expense ratio (0.5%-2.5%), exit load (if applicable) | Premium allocation, mortality, admin, and fund management charges | ₹100 (one-time account opening) |

| Tax Benefits (Section 80C) | Up to ₹1.5 lakh (ELSS only) | Up to ₹1.5 lakh | Up to ₹1.5 lakh |

| Withdrawals/Redemptions | Open-ended: Anytime; ELSS: After 3 years | Partial withdrawal after 5 years | Partial from 7th year; full after 15 years |

| Risk Level | Equity funds: High; Debt funds: Low; Balanced: Moderate | Moderate (depends on equity-debt mix) | Zero risk (government-backed) |

| Returns | Market-linked (potentially 10-15% for equity) | Market-linked (8-12%) | Fixed (currently ~7.1% per annum) |

| Transparency | High (daily NAV updates) | Moderate (periodic statements) | High (fixed interest rate declared annually) |

Who Should Invest in ULIPs?

ULIPs are suitable for:

- Investors who want both life insurance and investment in one product.

- Those comfortable with a 5-year lock-in and moderate risk.

- People looking for tax benefits under Section 80C.

- Investors who prefer flexibility to switch between equity and debt funds.

Note: ULIPs come with multiple charges, so make sure you understand the cost structure before investing.

Who Should Invest in PPF?

PPF is ideal for:

- Risk-averse investors who want guaranteed, safe returns.

- Those planning for retirement and willing to lock in money for 15 years.

- Conservative savers who want tax-free returns (EEE status).

- Investors looking for a government-backed savings scheme.

Who Should Invest in Mutual Funds?

Mutual funds are best for:

- Investors looking for wealth creation with market-linked returns.

- Those who want flexibility in terms of investment amount and withdrawal.

- Risk-takers comfortable with equity market volatility (for equity funds).

- Tax-savers looking for a short 3-year lock-in (ELSS funds).

Conclusion

All three investment options—ULIPs, PPF, and Mutual Funds—serve different purposes and cater to different investor needs.

- Choose PPF if you want zero risk, government backing, and tax-free returns, and you’re okay with a long 15-year lock-in.

- Choose Mutual Funds if you want higher returns, flexibility, and professional management, and are comfortable with market risk.

- Choose ULIPs if you need life insurance coverage along with investment, and are okay with higher charges and a 5-year lock-in.

You can also combine these options in your portfolio. For example:

- Invest in PPF for safe, long-term savings.

- Invest in equity mutual funds for wealth creation.

- Buy term insurance (cheaper than ULIP) and invest the difference in mutual funds for better returns.

Always assess your financial goals, risk tolerance, and investment horizon before making a decision. Diversification is key to building a strong investment portfolio.

Learn More:

- 10 Debt Mutual Funds That Outperformed in the Last 1 Year with 10% to 24% Returns in 2025

- Blue-Chip Stocks vs. Penny Stocks

- Delivery vs Intraday Trading

- Difference in Expense Ratio Between Direct and Regular Mutual Funds

- Best Small-Cap Index Funds

Disclaimer: This blog is for educational purposes only. The securities/investments mentioned here are not recommendations. Please consult a financial advisor before making investment decisions.