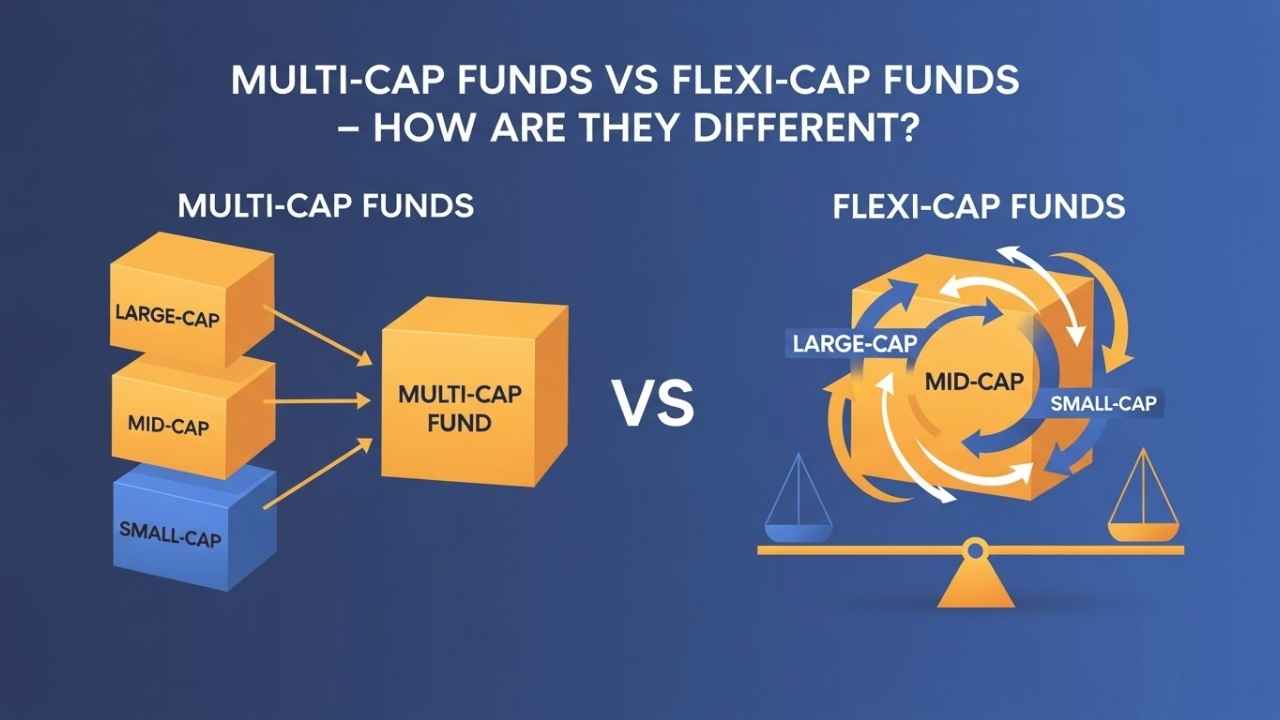

Mutual funds have become increasingly popular among Indian investors, and for good reason. They help us build long-term wealth while protecting us from inflation. When it comes to equity mutual funds, understanding the different categories can help you make smarter investment choices. Two popular options are Multi-Cap Funds and Flexi-Cap Funds.

If you’ve wondered which fund suits your investment goals better, you’re in the right place. In this blog, we’ll break down the differences between these two fund types in simple terms.

What Are Multi-Cap Funds?

Multi-Cap Funds invest across companies of different sizes—large-cap, mid-cap, and small-cap. Think of it as spreading your investment across the entire market spectrum. This diversification helps balance risk and return.

Key Features

- Equity Exposure: At least 75% of the fund must be invested in equity and equity-related instruments

- Mandatory Allocation: SEBI requires a minimum 25% investment in each category—large-cap, mid-cap, and small-cap

- Fund Manager’s Role: The manager selects stocks within these categories but must maintain the allocation balance

- Risk Level: Moderate to high, due to exposure to mid and small-cap stocks

- Investment Horizon: Best suited for 5-7 years or more

Tax Treatment

- Short-term gains (less than 1 year): 15% tax

- Long-term gains (more than 1 year): 10% tax on gains above ₹1 lakh

Who Should Invest?

Multi-Cap Funds work well for investors who want balanced exposure to companies of all sizes and are comfortable with moderate to high risk for potentially higher returns over the long term.

What Are Flexi-Cap Funds?

Flexi-Cap Funds are more dynamic. These open-ended equity schemes can invest in companies of any market capitalization without fixed allocation rules. The fund manager has complete freedom to adjust the portfolio based on market conditions.

Key Features

- Equity Exposure: Minimum 65% in equity and equity-related instruments

- No Fixed Allocation: The manager can invest any percentage in large, mid, or small-cap stocks

- Fund Manager’s Role: Has maximum flexibility to shift between market caps based on opportunities

- Risk Level: Flexible risk management through dynamic allocation

- Investment Horizon: Typically 5 years or more

Tax Treatment

Same as Multi-Cap Funds:

- Short-term gains (less than 1 year): 15% tax

- Long-term gains (more than 1 year): 10% tax on gains above ₹1 lakh

Who Should Invest?

Flexi-Cap Funds suit investors who want professional management with the flexibility to capitalize on market opportunities across different company sizes.

Multi-Cap vs Flexi-Cap: Key Differences

| Feature | Multi-Cap Funds | Flexi-Cap Funds |

|---|---|---|

| Equity Exposure | Minimum 75% | Minimum 65% |

| Market Cap Allocation | Minimum 25% in each cap (large, mid, small) | No fixed allocation rule |

| Fund Manager Freedom | Restricted by allocation rules | High flexibility |

| Portfolio Rebalancing | Must maintain minimum allocations | Can shift based on market conditions |

| Risk Management | Structured diversification | Dynamic risk management |

Benefits of Each Fund Type

Multi-Cap Funds

- Guaranteed diversification across all market capitalizations

- Exposure to stability of large-caps and growth potential of mid/small-caps

- Lower risk compared to pure small-cap or mid-cap funds

- Balanced approach suitable for most investors

Flexi-Cap Funds

- Flexibility to respond quickly to market changes

- Can increase allocation to better-performing segments

- Fund manager can reduce risk by shifting to large-caps during volatility

- Potentially better returns through tactical positioning

Which One Should You Choose?

The choice between Multi-Cap and Flexi-Cap funds depends on your preferences:

Choose Multi-Cap Funds if:

- You want mandatory diversification across all market caps

- You prefer a structured, balanced approach

- You’re comfortable with a longer investment horizon (5-7 years)

Choose Flexi-Cap Funds if:

- You trust the fund manager’s ability to make tactical decisions

- You want flexibility in market cap allocation

- You’re looking for a dynamic approach to risk management

Final Thoughts

Both Multi-Cap and Flexi-Cap funds offer excellent diversification opportunities, but they differ in their approach. Multi-Cap funds provide structured diversification with mandatory allocation rules, while Flexi-Cap funds offer dynamic flexibility to adapt to market conditions.

Before investing, consider your financial goals, risk tolerance, and investment timeline. You might even consider having both types in your portfolio for a balanced approach.

Remember, successful investing is about choosing funds that align with your personal financial journey, not just following trends.

Learn More:

- Blue-Chip Stocks vs. Penny Stocks

- Delivery vs Intraday Trading

- Difference in Expense Ratio Between Direct and Regular Mutual Funds

- Best Small-Cap Index Funds

- 10 Debt Mutual Funds That Outperformed in the Last 1 Year with 10% to 24% Returns in 2025

Disclaimer: This blog is for educational purposes only. The securities/investments mentioned here are not recommendations. Please consult a financial advisor before making investment decisions. Mutual fund investments are subject to market risks. Read all scheme-related documents carefully.